Farm enterprise analysis, or the practice of analyzing your cost centers, profit centers, and assets in your various farming operations to identify opportunities for optimization, is a critical part of maximizing your farm’s profitability.

NEWS & EVENTS

Farm Management Software & More

OUR BLOG

Why Management Accounting Still Needs Farm Enterprise Analysis

Topics: managerial accounting, farm financial statements, accrual accounting, farm financial reporting, agricultural managerial accounting, Farm Financial Standards, farm financial standards council

Agriculture Accounting: Big Buckets and the "Golden Rule"

Standardizing accounting practices for any industry can be incredibly difficult. In farming especially, there are countless variables that can severely impact the production numbers of a farm—everything from the vagaries of natural weather patterns to soil quality, crop/livestock genetic factors, and the availability of labor at an affordable cost.

Agriculture accounting needs to account for all of these variables and standardized, “Big Bucket” accounting solutions and practices often fail to, well, account for these variables and the impact they can have on farm operations.

Topics: accrual accounting, agricultural managerial accounting, farm inventories, farm accounting, agricultural inventories, quickbooks, activity-based costing

Growth Path Accounting 101- Everything You Need to Know

Over the past month, we’ve done a pretty comprehensive review of the different pathways on the growth path decision tree. As we prepare to enter a new year, many farm managers, owners, controllers, and accountants are starting to look at their accounting and consider whether they’re on the right path. There are a lot of decisions to make and, essentially, no right or wrong. If something’s working for you, that’s great. But, what if there were a better way out there? It’s worth investigating.

Quick Links

- What is The Growth Path Decision Tree?

- Determining Where Your Farm or Ranch is on The Decision Tree

- Challenges to the Growth Path System

- Using Farm Accounting Software to Inform and Improve Growth Path Accounting

What is The Growth Path Decision Tree?

Quite often, farmers and ranchers see computers as solely a back office function. In fact, surveys reveal that many believe accounting is their computer's most important function. Unfortunately, for many, selecting the right farm accounting system has been a hit-and-miss exercise. Often, many users cobble together spreadsheets and utilize software that’s not designed to account for the nuances and challenges of farm accounting.

Growth Path Accounting, however, provides farm managers with step-by-step procedures for selecting and maintaining accounting systems. The Growth Path concept relies upon some on assumptions including:

- Most farmers have varying levels of accounting experience and limited time for bookkeeping and accounting tasks.

- Every farmer has unique information goals that shift as their farm business grows. Small farms, obviously, have resources and goals that are quite different from large commercial farm operations with multiple locations producing a variety or greater volume of products.

- Education and training resources for farmers are time-consuming. Similarly, access and cost may also be issues.

However, understanding accounting methods can be vital to farmers hoping to gain greater insight into their farm operations, better understand their financial situation, and better prepare for the future. The amount of information you currently have and the amount of information you’d like to have can change your current accounting method. The Growth Path Decision tree is a key piece in understanding both where you are in terms of information and how you can leverage more data to make more strategic decisions.

Determining Where Your Farm or Ranch is on The Decision Tree

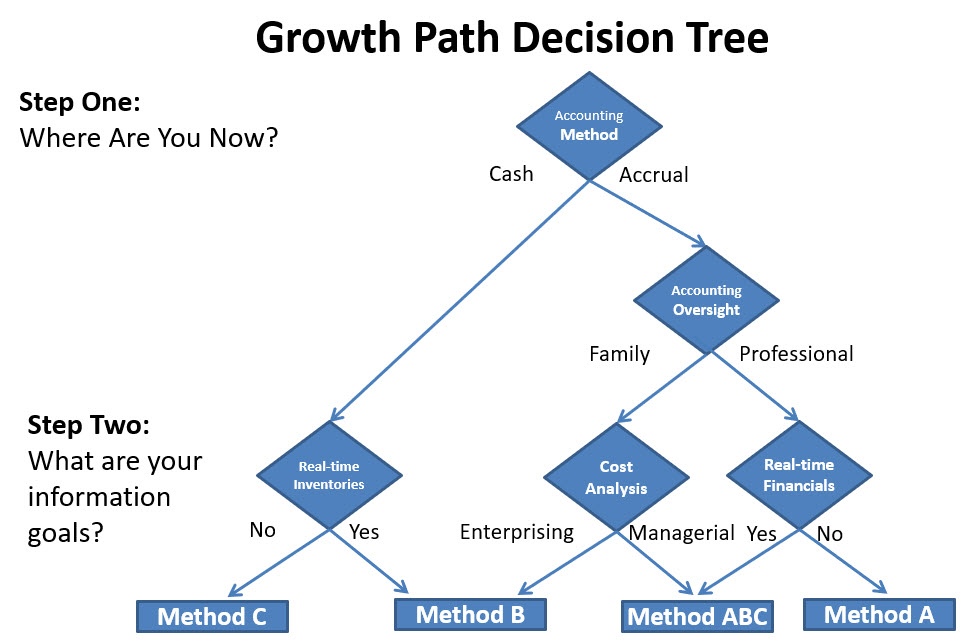

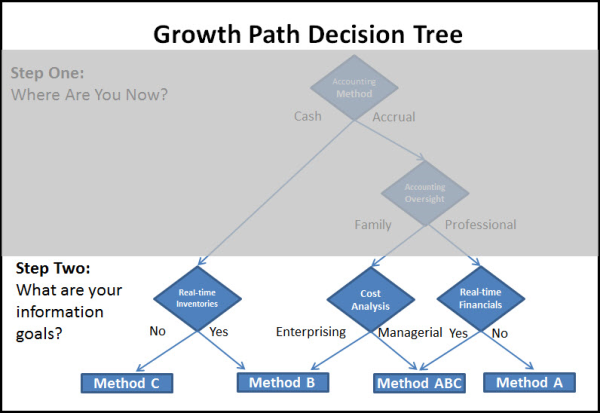

The first phase in Growth Path Accounting (GPA) is the determination of a starting system. To do that, you only need to answer two questions:

- Where are you now?

- What are your information goals?

Using this profile, GPA uses a "decision tree" to prescribe one of three growth paths leading to varying levels of practices and controls.

Where Are You Now?

To begin, you must review your past experience with accounting. The first "branch" in the decision tree simplifies this by asking Question One: "Is your current accounting method cash or accrual?"

You know you are currently cash if:

- You are using accounting software which records only checks and deposits to a checking account.

- Income and expense information is primarily used for tax reporting on the cash basis.

- Inventories, production records and financial analysis are maintained outside of your accounting system.

- Your balance sheet calculates net worth by subtracting liabilities from assets and values inventories at market value.

You're likely accrual if you're following all of these practices:

- You're recording double-entry transactions so that debits always equal credits and your balance sheet proves that assets equal liabilities plus owner's equity.

- You post expense transactions through accounts payable and revenue through accounts receivable.

- You accrue expenses like interest and taxes when they are incurred rather than when they are paid.

- You're valuing inventories at cost or lower of cost or market basis.

- Costs flow through raw materials, work in process and finished goods on the balance sheet and are not recognized on the income statement until they are sold.

Note that these are not hard and fast definitions but rather a shorthand process for categorizing your current accounting methodology. Exceptions to the rule may also exist:

- Cash systems may use external software (like Finpack and AFRA) to make year-end accrual adjustments.

- Accrual systems may be able to generate cash-basis financial reports.

- Just because your accounting system can do accrual accounting doesn't guarantee that you're doing it properly.

Who Oversees Your Accounting Process?

If you employ an on-site controller or CFO or you contract with a "virtual" accounting professional who oversees your monthly accounting processes then you have more capacity to move to the next level in your growth path. if your operation already includes a family member trained (and tasked) in accounting you've (potentially) got the best of both worlds. However, if either you or a family member with limited accounting training and time availability is trying to accomplish this on your own, it may be quite difficult.

Producers who use a strictly cash accounting method, can decide if they want to incorporate real-time inventories into their accounting system. By "real-time" we mean that crop, livestock, feed, seed, chemicals and fertilizer quantities on hand are updated through accounting entries. If real-time inventory control is not a priority then by default you have selected Method C, the most basic system. On the other hand, cash accounting producers who wish to track inventories will choose Method B, a "hybrid" system.

The next category is accrual accounting. For those relying on non-professional family members to oversee their accounting process, we assume this group is already committed to real-time inventories, so the decision they face regards cost analysis. If their goal is a traditional "enterprise analysis" approach of splitting expenses between commodities then they will also choose Method B. However, if they desire a more structured, multi-layered cost accounting system for allocating and flowing costs through their various management segments they will select Method ABC.

The decision for the final group, accrual accounting users relying on professional oversight, is whether they want their financial statements adjusted directly by real-time changes in raw material, work in process and finished goods inventories. Controllers who want to maintain a "high level" inventory valuation system not directly linked to production activities will choose Method A. Accounting professionals who want to "drive" financial statements from real-time activities will choose Method ABC.

Note that, according to the decision tree, while there are just four accounting "destinations," six different paths lead to those endpoints, representing a wide-ranging combination of starting points and priorities. That’s why assessing where you are and where you want to be is essential.

In summary:

- Choose Method C if your accounting process is strictly on the cash basis and you don't want to track inventories through accounting.

- Choose Method B if you want to add real-time inventories to your cash accounting system and/or incorporate enterprise analysis into your accrual system.

- Choose Method A will be your choice if your accrual books are maintained by accounting professionals who prefer to maintain financial statements independently from day-to-day farm production activities.

- Choose Method ABC if you are already on some form of accrual accounting if ownership desires managerial accounting (as opposed to enterprise analysis) and/or the accounting professionals require a tighter financial link to real-time changes in raw material, work in process, and finished goods inventories.

Even though our core business is in agricultural accounting software, we acknowledge that producers can and do achieve Methods C and A with off-the-shelf general accounting software. Conversely it's very convoluted and cumbersome to attempt Methods B and, especially, ABC without specially-designed ag software.

Challenges to the Growth Path System

Before we go into an in-depth comparison of the methods, we're pausing to answer potential objections to this "GPS" accounting implementation strategy.

Astute readers will have detected two potential flaws in the Growth Path System.

The first is that Growth Path Accounting does not attempt to "convert" anyone from cash to accrual or single entry to double entry (or vice versa). In fact, it's possible to go through the first phase of Growth Path Accounting without gaining any noticeable improvement over the financial information delivered by the current accounting system.

The second potential complaint arises from the fact that Growth Path users are limited to four seemingly-rigid choices in starting systems: Methods A,B,C and ABC.

Both of these criticisms need to be weighed against the objectives of Growth Path Accounting which are:

- To make better use of computer capabilities as quickly as possible.

- To learn advanced accounting skills at home at your own pace.

- To provide for future expansion to integrated farm records.

You cannot get off to a "fast start" computerizing a job that you have never done by hand. Too many farm accounting programs are now collecting "digital dust" because their owners bit off more than they could chew by selecting a program that could do everything but demanded more detail and precision than anyone on the farm could provide.

Growth Path Accounting compromises in this area by immediately producing useful information, regardless of the user's background or the method chosen.

Using Farm Accounting Software to Inform and Improve Growth Path Accounting

The key to success in Growth Path Accounting is in the ability of the farm accounting software to freely climb to more advanced levels as experience allows or needs dictate. Unfortunately, few programs have this capability. If properly designed, though, the four initial accounting systems are more than adequate starting points from which to reach the unique goals of most farm businesses.

That said, if you’re desirous of leveraging all of the data available to you through modern ag tech that means making a shift, even if gradual, to Method A, B, C. Farm ERP software can help you get there as can support from FBS Systems.

Reach out to our team today and let’s discuss where you are and where you’d like to be.

Topics: farm financial statements, accrual accounting, farm software, farm accounting, growth path accounting, Farm Financial Standards, agricultural inventories

For a long time, in the agricultural sector, technology, beyond farm equipment, was relegated to the back office. Thankfully, farms don’t operate that way anymore. In fact, most have learned to leverage ag tech to assist in improving productivity and profitability.

Topics: farm management accounting, cost accounting, accrual accounting, agricultural managerial accounting, farm inventories, farm software, agricultural decision support, agricultural software, enterprise analysis, farm budgeting, farm profit centers

When it comes to farming, much of what you do is about timing. Often, it doesn’t feel like there’s much time to make decisions, the seasons seem to come quickly, and the work of one leads right into another. But, taking the time to consider how you manage your farm accounting and understanding what those decisions mean is worth the investment.

Topics: farm financial statements, accrual accounting, farm financial reporting, farm inventories, agricultural software, enterprise analysis, agricultural inventories, cash or accrual, cost analysis, farm accountant

When it comes to farm oversight, understanding where you are, in terms of financial information and accounting is vital. Growth Path Accounting starts with asking where you are now and what your information goals are. Growth Path Accounting can be narrowed down to three objectives:

- Leveraging the technology available to you through software and applications

- Learning advanced accounting skills at your own pace

- Preparing you and your operation for future expansion to integrated farm records

To get there, you first need to understand Growth Path accounting and all of its separate parts. That informs not just your understanding of where you are and which accounting method you’re currently using, but also where you’d like to be and the advantages of the other accounting methods available to you.

Topics: managerial accounting, farm management accounting, accrual accounting, farm financial reporting, farm inventories, agricultural software, farm accounting, agricultural inventories, cash or accrual, farm accountant

Farm Accounting: Method B- The Farmer's Shortcut

Farming is about growth. It’s the primary focus from crop and livestock to the back office. Crops don’t grow from seed without external factors, nor does livestock. So how can we hope for our overall farm or ranch operation to grow without considering all the growth factors that allow the business side to thrive or wither?

And, when we see a challenge or opportunity to address a production shortfall, we look at all the options on the table. The growth path decision tree applied to farm accounting allows us to do the same. We look at the accounting decisions that impact our decision making process and assess how we can use accounting methods to improve our operations and profitability.

Topics: accrual accounting, farm accounting, enterprise analysis, growth path accounting, cash or accrual, cost analysis, integrated production and financial software

As a farmer, your day is filled with tasks. As a farm manager, your day is filled with decisions. From small to large, every decision you make will impact current and future operations. While a farm ERP solution helps you gather the data you need to make those decisions, you’re still left with options on when and how you implement it. It’s one reason we suggest creating a growth path decision tree, even when it comes to accounting. Each decision leads to more decisions and different outcomes. So, understanding the accounting implementations options before you, and the ways those decisions can impact your growth, is important.

Topics: cost accounting, accrual accounting, agricultural managerial accounting, farm accounting, ERP

"Becoming a farm CEO," an interview with Dick Wittman

| "What is the value of this kind of information if I can get it delivered to me in a more integrated fashion?" |

Topics: farm management accounting, accrual accounting, Dick Wittman, farm financial standards council, TEPAP, farm enterprise analysis, QuickBooks for agriculture, farm financial software

Farm Industry News Identifies Ag Accounting Trend

"If you’re struggling with a main street accounting program today, it might be time to reach out to a higher-level, farm-focused program for your business." So says Editor Willie Vogt in the April 2017 Farm Industry News cover story, "Raising Your Accounting Game."

Topics: farm management accounting, accrual accounting, farm financial reporting, ag software, farm accounting, integrated production and financial software, Quick Books

A previous installmentof Growth Path Accounting covered the Step Two question, "What are your information goals?" Before we go into an in-depth comparison of the methods, we're pausing to answer potential objections to this "GPS" accounting implementation strategy.

Topics: farm management accounting, farm financial statements, accrual accounting, farm financial reporting, enterprise analysis, agricultural inventories, cash or accrual, cost analysis

Growth Path Farm Accounting Information Goals

Topics: farm management accounting, cost accounting, farm financial statements, accrual accounting, farm financial reporting, agricultural managerial accounting, farm accounting, agricultural inventories, cost analysis, inventory valuation

Prescription Farming for Your Financial Records II

Last month we reprised a series that was first published over 20 years ago documenting a proven process used by a generation of FBS users. While technology has advanced in quantum leaps, the growing complexity of farming operations requires the same core decision-making processes to select, implement and grow an accounting system.

The Assumptions Behind Growth Path Accounting

Topics: farm management accounting, accrual accounting, ag software, agricultural software, farm accounting, growth path accounting

Topics: farm management accounting, accrual accounting, farm records, farm software, ag software, farm accounting, growth path accounting, systems development for agriculture

Why Wait 'till 2025 for Integrated Farm Records?

However, we believe most of the “goodies” envisioned in the article can be under your tree by 12/25 rather than 2025.

Here’s the real state-of-the-art for integrated farm records:

- Connecting production data directly with accounting software. FBS already includes “tight and right” integration between production activities/inventories and accounting based on common definitions that simplify input and produce comprehensive reports.

- Dozens of data silos. Last month we touched on the 50 or so sources of data we can import from, including precision farming technology, feed mills, packers and Conservis apps. Perhaps these diverse products will be more standardized in the years ahead through initiatives from organizations like AgGateway and informal market forces.

- Converting production to accrual. E.CLIPSE managerial accounting automatically converts activities to costs that flow from raw materials through work in process through finished goods on the balance sheet to cost of goods sold on the income statements.

- More accurate equipment and labor records. E.CLIPSE also performs activity-based-costing to monitor the resources consumed through each phase of production and match those costs with hours, acres, miles, bushels, pounds and head.

- Electronic invoices. Even though there’s little standardization yet in agribusiness FBS can already import invoices and sales receipts from a wide range of formats and transfer the management detail (quantities, groups, fields, products) as well as the dollars into the farm’s central accounting and management information system.

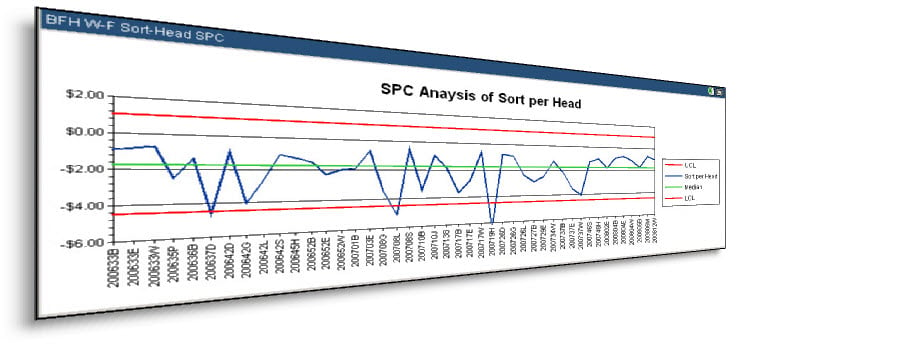

- Smart data/measuring what you manage. Rather than viewing accounting as a “rear-view” of a business used to determine historical “cost of production” for raised products (which are often affected by external factors like weather and disease), activity-based costing evaluates the efficiencies and margins of each responsibility center.

- Virtual CFO. Just as progressive, growing operations rely on internal specialization and outside consultants for production analysis they are also tapping into virtual CFOs and controllers who can remotely oversee the financial details of the business.

- Google Glass. OK. Unlike the other technologies, most of us will have to wait a few more months before we find this “toy” in our stockings.

Topics: accrual accounting, agricultural managerial accounting, agricultural software, Top Producer Magazine, activity-based costing, Farm CFO, integrated farm software

Farm Futures Points to the Future of Farm Financials

The November 2013 issues of Farm Futures Magazine is packed with valuable tips for guiding you to the financial future of your farm.

Topics: managerial accounting, farm management accounting, accrual accounting, agricultural managerial accounting, Top Producer Magazine, Dick Wittman, farm financial standards council, Danny Klinefelter, Farm Futures Magazine, Lance Woodbury, integrated software

Farm Computer Adoption Pain Exceeds Management Gain

Two recent articles in the farm press validate how far farm management technology has come, yet how far it has yet to progress to make a serious business impact.

Topics: managerial accounting, farm management accounting, cost accounting, farm financial statements, accrual accounting, farm financial reporting, agricultural managerial accounting, farm inventories, farm records, farm software, ag software, agricultural decision support, business processes, agricultural software, farm accounting, enterprise analysis, precision farming

Is Your Farm Management System Stuck in a Rut?

Topics: managerial accounting, cost accounting, farm financial statements, accrual accounting, agricultural managerial accounting, farm records, farm software, best practices, farm budgeting, agricultural inventories, activity-based costing, Dick Wittman

We ran across this AgTalk post by Mark Wilsdorf, who markets an add-on to Quickbooks for farmers. If anyone has figured out how to make this ubiquitous small business accounting program function as an effective farm financial management tool it would be Mark.

Topics: farm financial statements, accrual accounting, farm financial reporting, quickbooks, cash or accrual

Attendees at the 2011 Ag Bankers Conference experienced a warping of the time-space continuum as 93 percent reported that their farm customers were managing their farms like it was 1981, not 2011. Unbelievably, only seven out of 100 lenders had clients using accrual accounting.

Topics: farm financial statements, accrual accounting, Farm Financial Standards

RELATED POSTS

Limitations of Farm Accounting and Business Intelligence Software

Farm accounting got you stumped? In the ag industry, many farmers rely on preparers for their farm accounting needs, but those services aren’t always...

What are Business Intelligence Tools in Agriculture?

According to IBM, business intelligence isn’t a new concept. But, it wasn’t until the 1990’s that data management systems really took off, despite...

Advancements of Farm Automation Practices

To be a technology driven business, you need to explore new innovations as they emerge and, let’s face it, agriculture is, increasingly, dependent...

Data Visualization: Why Farms Need Power BI™ Solutions

As a business operator, you likely rely on your data to drive decisions. Once you receive the raw numbers, what do you do with it? An abundance of...

Buy or Build an ERP? 4 Methods for Effective Farm ERP Implementation

Are you looking to switch from legacy tech to an advanced ag-specific ERP tool? Enterprise resource planning tools designed for farmers account for...

Cloud Tech: The Pros and Cons of Cloud Connections

By 2034, it’s estimated that farms will generate more than 4 million data points in a single day. How is this possible? Smart technology and...

Can Cloud Data Management Enhance Financial Control?

New technology is being utilized across numerous industries, and it’s rapidly changing the way that we live and work. You’ve likely heard of “The...

4 Farm Accounting Mistakes You Might be Making

Have you been struggling to assemble accounting documents for your farm? With such large enterprises and a range of inventory, assets, and employees...

Ag Tech Spotlight: Digital Twins for Farm Data

Some days it’s tough enough to keep up with the work, whether it be in the back office, field or barn, or both. This is, perhaps, one of the daunting...

5 Farm Data Reports You Should be Tracking

Looking to improve the success of your farm business? Farm data reports might be the key to unlocking your potential. Think of these data insights...

What You Need to Know About AI in Farming

Artificial Intelligence (AI) has left no stone unturned. Nearly every industry is talking about the ways it will impact them and what opportunities...

Integration Through Enterprise Resource Planning Software

Have you ever struggled with inaccurate data as a result of legacy tools or errors made as a result of manual entry? Truthfully, most businesses have...

6 Tips for Implementing Farm Financial Standards Council Guidelines

Eisenhower once said "Farming looks mighty easy when your plow is a pencil and you're a thousand miles from the corn field." But for the back office,...

What Are Generally Accepted Accounting Principles? (+Reasons to Follow Them)

There are few things more important in accounting than accuracy, especially when managing your farm and making strategic decisions relies upon those...

Sign Up for the 2023 Agriculture Software Success Summit!

Get excited for this year’s BOOST/23 Agriculture Software Success Summit with FBS Systems! This November, join us for an exclusive event that...