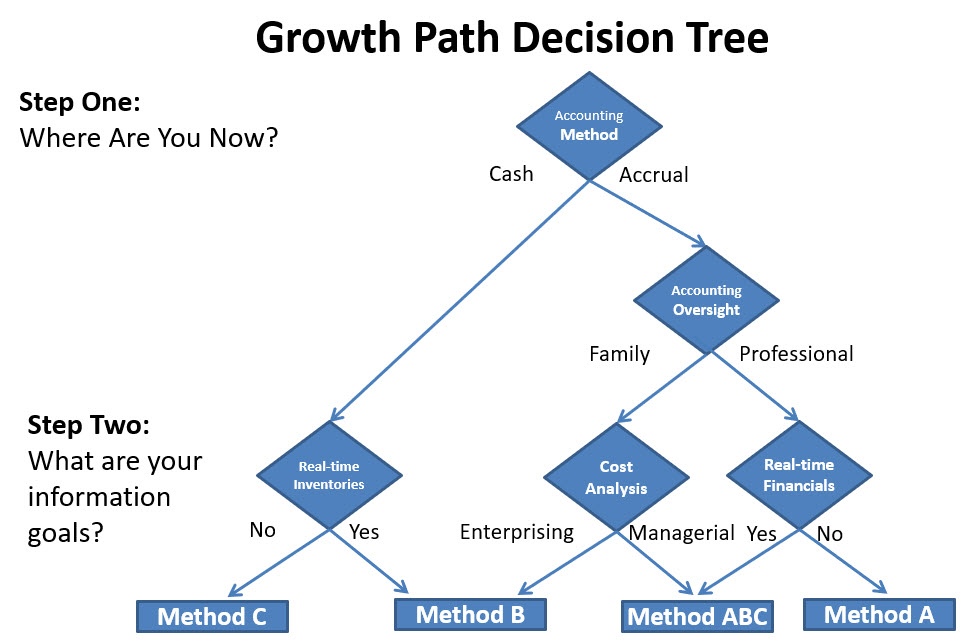

As a farmer, your day is filled with tasks. As a farm manager, your day is filled with decisions. From small to large, every decision you make will impact current and future operations. While a farm ERP solution helps you gather the data you need to make those decisions, you’re still left with options on when and how you implement it. It’s one reason we suggest creating a growth path decision tree, even when it comes to accounting. Each decision leads to more decisions and different outcomes. So, understanding the accounting implementations options before you, and the ways those decisions can impact your growth, is important.

Quick Links

- General Accounting Implementations: A, B, C, ABC

- When to Use the ABC Method in Farm Accounting

- ABC Method Accounting in Agriculture

- Challenges of ABC Accounting

- Benefits of the ABC Method in Farm Accounting

General Accounting Implementations: A, B, C

When it comes to accounting implementations, there are four options. Each method comes with its own challenges, benefits and best uses. As a brief overview,

Method A is stand-alone accrual accounting. Accrual accounting matches both expenses and revenue to when they are incurred vs when payment is made or received.

Method B is a "hybrid" of cash accounting and integrated production records sometimes referred to as the “farmer’s shortcut.”

Method C is cash only reporting which means expenses and revenue are tied to when payments are made or received. It’s simple and straightforward, especially for tax purposes, but excludes inventories and financial analysis.

Method ABC is the fourth option designed for managers who find all the other methods falling short of their requirements. As it incorporates all the other methods, it’s true hybrid accounting providing the best of all implementations.

To further understand these methods, let’s take a quick look at single and double-entry accounting. Single entry accounting, like cash, has one entry. Expense? One entry. Cost? One entry. In contrast, double entry accounting records a debit and credit for every transaction, maintaining a balanced balance sheet . Obviously the double entry methods are more complex, but they can improve accuracy, and record reliability while providing a clearer overview of your farm’s financial situation.

When to Use the ABC Method in Farm Accounting

One of the decisions you have before you, is how you handle the accounting for your farm or ranch operation. That means knowing when it’s best to use each of the available implementations out there.

Method ABC is great if your accounting staff is already preparing real-time accrual financial statements and are looking for an automated way to update those statements from internal business activities.

It’s also a great idea if you want to move beyond simple enterprise analysis to tighter allocation, reporting and control of your major business segments (farms, fields, animal groups, and support centers like equipment, facilities and activities).

ABC Method Accounting in Agriculture

If you're looking to make the most of the data you have at your fingertips, or looking to add a farm ERP solution to leverage that data, then the ABC method may be more than appropriate. So, what does the ABC method look like when it comes to farm accounting?

- Integration with production information. If you're tracking field or livestock performance records, the direct and indirect costs will come through your accounting records.

- Cash and/or accrual accounting. You can continue reporting taxes on a cash basis but also produce accrual financial statements.

- Real-time cost-basis inventories. Both accounting and production events will drive inventories. Inputs like seed, chemicals, fertilizer and feed and growing/harvested crops and growing animals will be valued at actual cost.

- Tight accounting tie-out between physical activities and financial statements. All raw material, work in process and finished goods inventories flow through the balance sheet and income statement without losing management detail, permitting "slice and dice" analysis at any level and any point in time.

Challenges of Method ABC

While a "mountain top accounting experience," Method ABC is definitely not for everyone. It comes with some significant benefits, which we’ll get to in a moment, but as with all systems, there are some challenges.

- System cost. There's an up-front cost to knowing your costs. Specialized vertical market software always costs more than generic accounting software.

- Learning curve. If your current practice is do-it-yourself Method C or accountant-generated Method A, adopting Method ABC will require a more structured view of your business. FBS provides training and consulting in this field following the Farm Financial Standards Council MANAGEMENT ACCOUNTING GUIDELINES.

- Staff and professional involvement. You don't have to have a full-time controller to take advantage of Method ABC but you may need to collaborate with trusted professionals and get support from your partners.

- Requires a company culture that values and uses information. If you're an accounting "lumper" rather than a "splitter," are having trouble collecting data from employees or view accounting as nothing more than a "necessary evil" for the banker or IRS, then you're not ready for Method ABC.

Benefits of Method ABC

Benefits of Method ABC

Even with those challenges, the ABC Method, combined with the right tools, can improve your management accounting and your decision making, especially when it comes to growth.

- Accounting control of your business at the same level as you manage whether that’s by commodity, production year, farm, field, group or support activity. Other alternatives may "plug" costs into livestock closeouts or field reports but performance doesn't feed back into accounting and accounting doesn't drive all costs down to the field or group.

- Provides controllers, auditors and lenders an interlocking detailed audit trail that emulates accounting principles followed by the manufacturing world and the FARM FINANCIAL STANDARDS COUNCIL.

Streamline your accounting by continuing to record most accounting transactions as expenses or revenues with the accrual inventory and expense adjustments occurring automatically "behind the scenes."

- Improve employee efficiency. Your production employees won’t have to allocate costs nor will your accounting employees perform manual work-in-process adjustments. Allowing your teams to focus on their roles and tasks means you get more accurate data and better productivity.

When it comes to farming, your big decisions don’t happen in the field. They happen in the back office. How you choose to keep your books and maintain your records has a significant impact on your finances and your future.

At FBS Systems, we understand farming and we understand accounting. That’s why we designed our farm ERP software to help you employ whichever accounting implementation works for you. If you’re ready to see how an integrated accounting solution can help you grow, strategically, book a demo today.