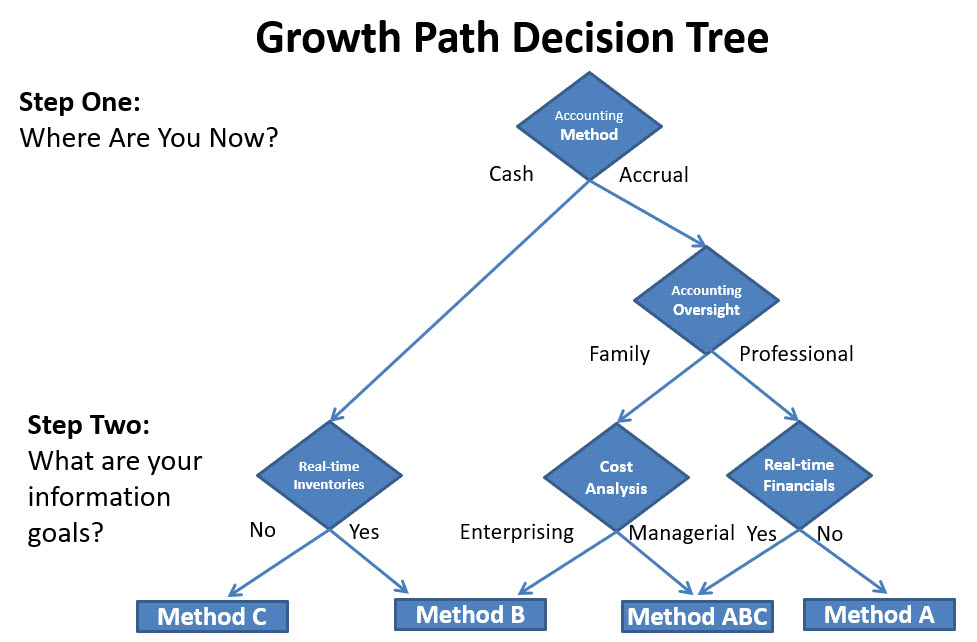

When it comes to farm oversight, understanding where you are, in terms of financial information and accounting is vital. Growth Path Accounting starts with asking where you are now and what your information goals are. Growth Path Accounting can be narrowed down to three objectives:

- Leveraging the technology available to you through software and applications

- Learning advanced accounting skills at your own pace

- Preparing you and your operation for future expansion to integrated farm records

To get there, you first need to understand Growth Path accounting and all of its separate parts. That informs not just your understanding of where you are and which accounting method you’re currently using, but also where you’d like to be and the advantages of the other accounting methods available to you.

Quick Links

The Growth Path Decision Tree and Farm Accounting

The Growth Path concept hinges on a few simple assumptions. These include:

- Most farmers have varying levels of accounting experience and limited time for bookkeeping.

- Each farmer's information goals are as unique and constantly changing as their farm business. Small farms, obviously, have much different goals than a large commercial farm operation with multiple locations producing a variety or greater volume of products.

- Farmer-accessible education and training can be difficult to find, time consuming, and expensive.

However, a greater understanding of accounting methods can help farmers gain greater insight into their farm operations and better understand their financial situation. The amount of information you currently have and the amount of information you’d like to have can change your current accounting method.

That process, of course, comes with understanding each of the farm accounting methods available to you.

What is Method A Accounting?

Method A in Growth Path Accounting focuses on accrual and uses that as the primary accounting method. Accrual accounting means your farm or ranch records expenses as they’re incurred and your revenue when the goods/services are sold even if payment has not yet been received.

As you can imagine, this can make farm accounting complicated because of overlapping production cycles and complicated inventory management.

When to Use Method A Accounting in Farm Accounting

If your current accounting method is strictly accrual, you're using professional accounting oversight, and you're not concerned with real-time inventories and/or managerial cost accounting, you've already selected Accounting Method A (Accrual Focus).

Using Method A accounting means:

- No integration with production information. If you're tracking field or livestock performance records, they'll be isolated in separate, unconnected databases (or sheets of paper).

- Limited cash accounting. Producing a cash-basis Schedule F tax return will likely require meticulous external adjustments.

- Partial inventory tracking. Even if your accounting system includes an inventory module it's likely not easily adaptable to the detail and dynamics of agricultural inventories so you probably will also rely on separate forms or spreadsheets.

- "Mainstream" GAAP accounting that reliably reports historical financial activity at the expense of farm management detail.

-

Benefits of Method A in Farm Accounting

Benefits of Method A in Farm Accounting

Despite the challenges, and beyond being able to leverage the advice of those in more traditional accounting roles, Method A does have its advantages.

- Produce accrual financial statements that accurately compute profitability.

- Traditional accounting backgrounds can produce and understand the reports.

- Works with an "off-the-shelf" accounting program rather than more expensive and specialized ag accounting software.

- Doesn't require agricultural knowledge or understanding.

In short, the biggest advantages to Method A are realized when you choose to adhere to more traditional accounting rules, but that can create challenges for agricultural management.

Challenges of Method A in Farm Accounting

As noted above, Method A, especially in farm accounting, can create some obvious challenges. While it’s beneficial for preparing accrual financial statements, other financial planning and decision making can be more difficult due to a lack of a complete accounting picture.

- Hard to monitor cash tax position because of the timing differences in cash and accrual transactions.

- No unit cost analysis by commodity, crop year, farm, field or group.

- Restricted accounting control because of the challenges of inventory control or reconciliation.

- Requires formal accounting training to maintain.

Many larger farms choose Method A strictly on the advice of their CPA, controller, or CFO, because it's what these professionals are already comfortable with. However, that doesn’t always mean it’s what’s best for farm management or ranch operations.

There’s no right or wrong when it comes to Growth Path Accounting. It’s all about the needs and goals of your farm or ranch. Still a greater understanding of the options available to you may help shed some light on the direction you’d like to head in, particularly when it comes to leveraging the farm software and applications available to you. Farm ERP solutions, for example, can help you leverage data and turn it into financial control and oversight.

Further, the right farm accounting software can help you manage your books more effectively, especially if you’re using a true hybrid accounting method that includes inventory and production while blending both accrual and cash accounting. If you’re ready to talk more about your options and how the right software and solutions, designed specifically for agricultural accounting, can help you reach your information and financial goals, reach out to the FBS Systems team today.