For modern farmers, agriculture technology has become an integral part of business. However, when most people think of “ag tech,” farm accounting solutions might be one of the last things that they think of.

To ensure that farms are optimized and profitable, farm management accounting practices are essential. Using relevant financial data to inform business decisions can help you make your farm more profitable in the long term by identifying which activities are driving up costs and which ones are most heavily linked to your farm’s revenue generation.

This can help you optimize your farm’s financial management and overall business strategy to maximize profitability. But what role does ag tech play in farm management accounting? What are some of the barriers to adoption that you might need to overcome? How does FBS’ solution integrate data for you so you can make farm management accounting easier?

Agriculture Technology and Farm Management Accounting

Farm management accounting, or the application of financial data and advice to optimize the organization and development of a farming business, is a cornerstone of success for many of the largest farming operations.

By accounting for cost of all activities on a farm and attributing each one to a specific production end result (i.e., activity-based costing for margin analysis), farmers can improve the consistency of their profits by identifying less-profitable, yet expensive, activities that don’t contribute as much to the farm’s revenue as more profitable, but less costly, ones. With this information, it’s easier to adjust your farm budget moving forward to focus on high-value activities.

Agricultural technology can play a key role in management accounting on a farm. With the right farm tech tools, farmers can harvest data from their primary cost or activity centers, tracing every dollar spent and every dollar earned more easily to see which activities are contributing to profits and which ones are a money pit that don’t produce results.

Challenges to Agriculture Technology Adoption for Farm Management

While ag tech—and especially farm accounting software—can be incredibly useful for a farming enterprise, there are some barriers to adoption that can keep a farming business from benefiting from these tools.

1: Reliance on Legacy Systems

For example, many farmers are using legacy systems—old software and hardware that hasn’t been updated in years—that they’re already comfortable with. Because they understand these systems, they’re often resistant to the idea of making a change. It’s the classic “if it ain’t broke, don’t fix it” mindset. However, the problem with legacy systems is that they often are “broke,” even if only because they haven’t been updated to modern standards in years.

There may be business processes or regulations that the old system can’t account for simply because, at the time it was last updated, those processes or rules didn’t exist yet. Also, these systems often don’t play nice with modern, cloud-based data sources—making it near-impossible to collect data from your fields, feedlots, feed mills, equipment, or other activity centers on your farm in real time.

2: Lack of Resources to Integrate New Farm Technology

Switching to a new piece of technology can be a challenge. Even when a software program can run on the computers you already have, it takes time to learn that new system well enough to make the best use of it. And then there’s the issue of integrating your farm management software with your farm’s existing processes.

It takes time and resources to onboard a new farm tech solution and integrate it with your practices. Not just for you (or your accountant) to learn the new software, but for the workers in your different operations centers to learn how to work with the tech and make it useful to them.

A lot of farmers are already busy with their daily operations and just don’t have the time or the energy to provide everyone who’ll be interacting with the software a personal overview of it and why it’s important. This is one reason why it’s important to find an ag tech partner that offers ongoing service and support to help with onboarding and user training.

How FBS Integrates Data

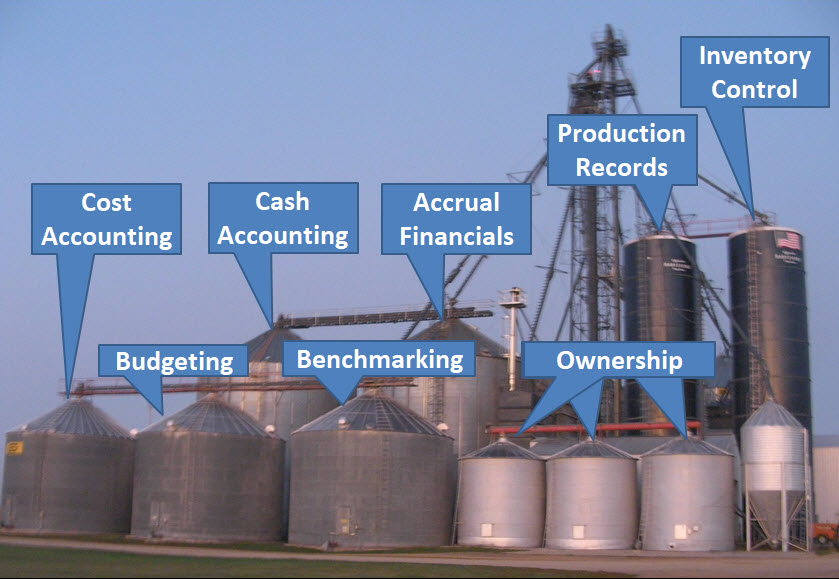

If you’re like many growing, progressive producers your scale and complexity are working against you because this vital information is housed in separate “silos” consisting of unconnected accounting and production software supplemented by countless spreadsheets.

The integration of production and financial data is considered by many to be the "Holy Grail" of farm management. This is why FBS's integration model adapts to both internal and external data.

Internal Integration

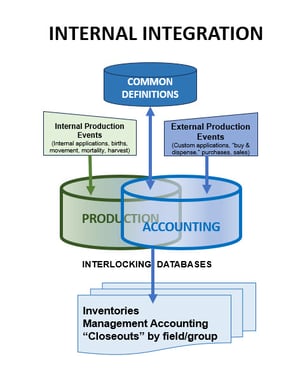

By using a "master" list of products, locations and groups and "interlocking" accounting and production databases, the FBS model:

By using a "master" list of products, locations and groups and "interlocking" accounting and production databases, the FBS model:

- Eliminates redundant setup

- Provides real-time inventory control by recording purchases and sales through accounting and applications, movements, mortality and harvest through production activities.

- Permits direct buy/dispense entries to a field or group.

- Allows indirect buy now/use later transaction so that the accounting department doesn't have to know when and where an inventory item will be consumed and the production department doesn't need to know the purchase history or cost of the item.

- Uses production records (acres/hours/days) as "cost drivers" to automatically and precisely allocate overhead for precise cost analysis/"closeouts" at the field and group level.

External Integration

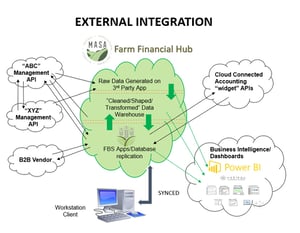

In a perfect world, every software product would use standardized definitions for products and locations making communication between production and financial programs a straight-forward process.

In a perfect world, every software product would use standardized definitions for products and locations making communication between production and financial programs a straight-forward process.

Since that's not how the world actually functions, FBS has built interfaces with over 60 feed mill, precision farming, and packer formats. All of these interfaces use FBS's "data bridge" technology to incrementally "translate" the language of the other technologies.

The next data integration step is a full cloud-based Farm Financial Hub that can communicate in real-time through application programming interfaces (APIs) with management applications such as field operations, livestock monitoring, markets, maintenance, and document processing. This will also result in a structured data warehouse that can be queried by business intelligence software and automated dashboards.

Grow Your Farm with Financial Management Tech Solutions from FBS

Are you ready to leverage tech to enhance your farm management strategy? Reach out to FBS today and speak with a member of our team about how our farm ERP solution combines farm management and accounting solutions to streamline your operations and improve profitability.