Margin analysis, or marginal analysis, is the practice of examining the cost of a good or service versus the potential benefit of that good or service. Even if you hadn’t heard of the term before, odds are you’ve made this comparison for yourself countless times as a farm owner or operator. However, there’s a danger to basing margin analyses on general assumptions—which is why it’s important to utilize activity-based costing.

What Is Activity-Based Costing?

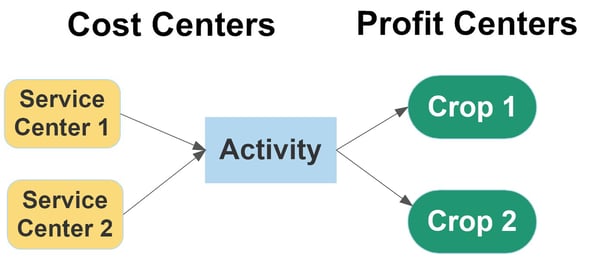

Activity-based costing (ABC) is an accounting practice where overhead and indirect costs are connected to specific products and services. As noted by Investopedia, ABC “recognizes the relationship between costs, overhead activities, and manufactured products.”

This sounds similar to margin analysis in that it relates costs to production. However, basic margin analysis looks primarily at direct costs of production without accounting for overhead. Engaging in activity-based costing as part of your margin analysis gives you a more comprehensive look at your real cost of production and the margins you can expect for different farming enterprises.

Farm Enterprise Accounting Problems

So, what’s the problem with margin analysis in your farm enterprise accounting? The basic task of looking at the margins for specific activities in your farm can be valuable for any farm. However, there are a few key problems with farm enterprise financial analysis:

- Allocations are frequently more arbitrary than accurate.

- Whole-farm accrual financial analysis is often not reconciled with enterprise profits and losses.

- Knowing the cost of performing a production activity is as important as knowing the ultimate cost of the product itself.

- Without standards for analysis, reliable comparisons between databases and farms is impractical.

These enterprise accounting problems can inhibit a farm’s financial analysis—leading to inaccurate assumptions that compromise the farm’s ability to operate at a consistent profit.

For example, when an accrual-based financial analysis isn’t reconciled with the farm’s P&L, there may be shortfalls in cash flow as costs arise before revenues do. Or, when allocations are arbitrary (such as applying the cost of all farm machinery equally to every enterprise regardless of use case), some low-impact enterprises may reflect a lower profit margin than they actually generate.

This is where activity-based costing can help to improve your margin analysis.

The Basics of Activity-Based Costing

The basic strategy for activity-based costing can be broken down into two key steps:

- Step 1: Post All Indirect Expenses to Cost Centers

- Step 2: Allocate Cost Centers to other Cost Centers or Profit Centers

Sounds simple, but this process can be much more complicated than initially assumed.

To get a reliable ABC calculation, you need to identify all of the activities needed to create a product. It is the activities that create costs and activity-based costing determines why costs occur and how they are absorbed into “cost objects” rather than simply allocating what’s already been spent.

So, the full ABC process looks more like this:

- Identify All Activities Required to Create a Product. Assess each enterprise in the farm and identify every activity that is required to create a finished “product.” Every watering of a field, every instance of feeding an animal, every acquisition, storage activity, etc. This helps to identify what equipment is used for each enterprise at what times—helping to increase the accuracy of cost assessments.

- Divide Activities into Cost Pools or Objects. Take each of the individual costs associated with an activity to calculate the total overhead for that activity.

- Assign Cost Drivers to Cost Pools. For each activity, decide how to categorize the cost drivers associated with the activity, such as hours for time-based activities or production units/unit weights for production-focused ones.

- Divide the Total Overhead of Each Cost Pool by Their Cost Drivers. This will help you determine the cost driver rate.

- Multiply Cost Driver Rate by the Total Number of Cost Drivers. This helps you get a solid estimate of how much net revenue you could expect to generate from your current list of cost driver activities.

Benefits of Activity-Based Costing

So, how does activity-based costing help a farm? Some of the benefits of an ABC process for analyzing farm margins include:

- Greater reliability for your product cost accounting, inventory valuation, marginal cost analysis, and farm financial reporting.

- Simplified data entry and the ability to automate allocations of costs for enterprises that you’ve run through activity-based costing.

- Rolling up your internal services to equivalent levels/rates with external services.

- Improved monitoring of costs, personnel, and performance from within your farm’s responsibility centers.

- Enhanced traceability for costs that are often considered “indirect” because they’re tied to specific farm activities.

Watch Out for Period Costs in ABC

One thing that can complicate an activity-based costing analysis is the existence of period costs. These costs are independent of production and are not tied to any inventory—which means that they’re difficult to account for in ABC analyses.

For example, selling, general and administrative (SGA) expenses, marketing expenses, and other fixed costs of the business. Your SGA expenses will remain the same for any given period of time regardless of whether you produce two tons of a crop or 20 tons.

Also, period costs are put on the income statement when they’re incurred, and not when the product is sold or paid for. This complicates your farm accounting and cash flow projections.

So, when conducting margin analysis with ABC methods, it’s important to have a consistent method of applying period costs to your farming activities or to account for them on top of your variable costs that are tied to production.

Get a Farm ERP Solution That Supports Activity-Based Costing

Are you considering updating your farm accounting systems to use activity-based costing as part of your farm financial analysis? Farm ABC is impractical unless you have a means of:

- Allowing multiple levels of allocation and responsibility centers to “roll up.”

- Integrating cost drivers with production records.

- Performing work in process and inventory adjustments as needed.

- Retaining cost center details after they have been allocated to products.

- Automating all of the above for consistency.

However, there’s a solution that can help: FBS’ farm ERP solution. FBS integrates data sources from your production process with your accounting to enhance traceability of costs, simplify ABC margin analysis, and create reports so you can track everything in real time.

Reach out to FBS today to get started on improving your farm margins analysis and profitability with dedicated software solutions made by farmers, for farmers.