When it comes to your farm accounting practices, what accounting method do you use the most often? Do you stick with easy-to-implement, but ultimately low-value cash-based accounting or do you employ more rigorous (and valuable) methods?

Whether you’re a farm accountant or the owner/operator of your farming business, the accounting methods you use can have a major impact on your farm’s success. With robust insights into your cost and profit centers, you can more easily make informed decisions that maximize profitability across all of your farming enterprises.

But what are the different farm accounting methods you could be using? What’s the benefit of using a more involved accounting method—and is it worth the extra time and effort spent to be so much more detailed?

Let’s take a look at the different farm accounting methods to find out.

What Are the Different Farm Accounting Methods?

For the purposes of this post, we’ll stick to four primary accounting methods: A (Accrual), B (Hybrid), C (Cash), and method ABC (Integrated Cash, Accrual and Managerial).

Of these, the most common accounting method we’ve seen farmers use (at least initially) is method C (cash). Why? A lot of the time, it’s because it’s the easiest. Tracking income and expenses as they occur is a relatively simple process that doesn’t take a lot of time. However, it doesn’t provide much in the way of value, either.

Meanwhile, larger, more well-established firms tend to use method A (accrual) because it’s more widely accepted by accounting professionals.

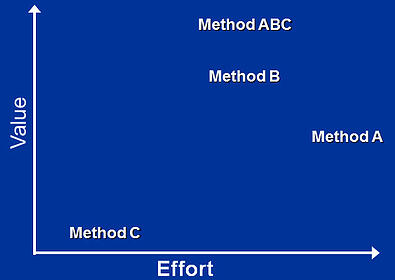

Here’s a quick graphic showing the value of each accounting method versus the amount of effort required for it:

Method A: Accrual

Accrual accounting is so named because of the method used to record both incoming and outgoing payments. Here, the payment is recorded at the time of the transaction instead of when the money actually clears.

This method produces accrual financial statements that summarize the overall profitability of the business. However, those statements don’t explain what internally contributes to any profit or loss. Moreover, this method requires professional oversight and a great deal of manual accrual adjustments so requires the most effort of all the methods.

Method B: Hybrid

Hybrid accounting combines elements of both cash and accrual accounting for different types of income and expenses within the farm. This can complicate your accounting and it demands diligent inventory control and production records. That being said, it also generates direct cost analysis at the commodity and location levels.

Method C: Cash

Cash accounting only tracks when money enters or leaves the business—not when the transaction leading to that debit or credit is made. For example, if you sell a ton of finished product one month, then finally get paid two months later when it finally arrives at its intended destination, the cash method would record the income at the point of collection two months after the sale contract was signed.

The issue with this method is that, as previously noted, it requires minimal effort but delivers very little value (cash-basis ledger balances for tax returns). There isn’t much of a way to anticipate upcoming payments or to make business plans around outgoing or incoming money. It’s living paycheck-to-paycheck but for your whole farming business.

Method ABC: Integrated Cash, Accrual, and Managerial

Method ABC, or integrated cash, accrual, and managerial accounting is a lot like hybrid accounting but taken to a whole new level. This method requires about the same effort as Method B. However, it automates accrual financial statements and tracks activity as well as field and feedlot level costs and margins.

It’s an accounting strategy that fits well with the actual financial reporting and tracking needs of farms. While this process is involved, farm accounting software can help you streamline the implementation of comprehensive ABC accounting to give you the most valuable insights while reducing the burden of such a detailed accounting methodology.

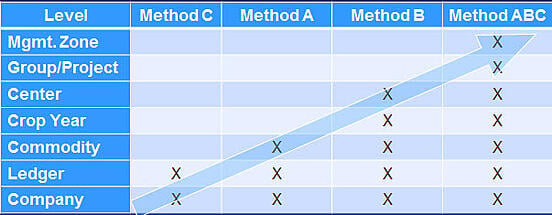

How much more data can be gathered under each type of farm accounting methodology?

Here’s a quick graphic to explain:

This is not to say that, if you currently use method C or A, that you’re stuck with that method forever. It’s possible, though somewhat challenging, to switch your farm accounting strategy to increase visibility into your finances and business processes so you can more effectively grow your business.

Switching Farm Accounting Methods

If you want toset your farm on a growth path, odds are that you need more, and timelier, accounting information. But, how can you outgrow your current accounting methodology to get that data?

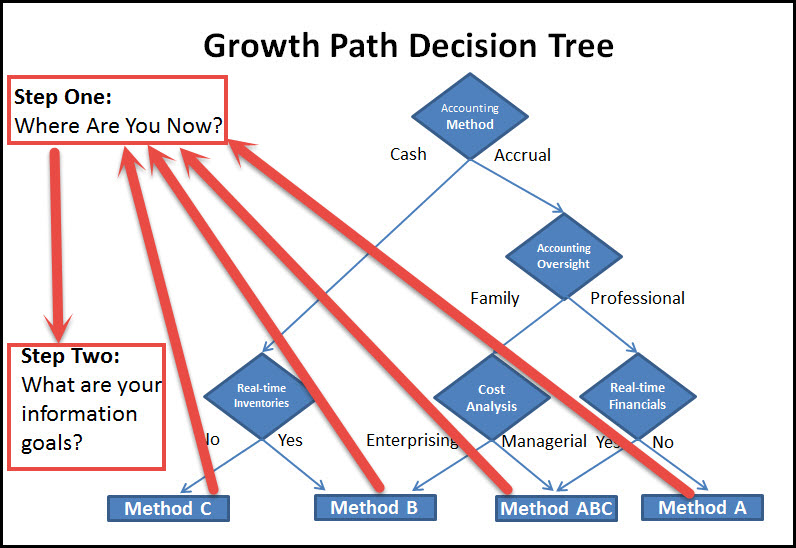

The “Growth Path Decision Tree” is one way to visualize the journey from method C accounting towards more comprehensive methodologies that better fit your business plans.

It might help to remember that “Growth Path Accounting” is a journey, not a destination. You can use its built-in diagnostic tools to reevaluate and adjust your practices at any time. It's just a matter of "looping" back to the original two steps and augmenting them with supplemental questions.

Here are the steps to following this path to continuous accounting performance improvement:

Step 1. Ask Yourself “Where Am I Now?”

At this point you should have clearly identified your current accounting level: A (Accrual), B (Hybrid), C (Cash) or ABC (Integrated Cash, Accrual and Managerial).

Step 2. Determine Your Information Goals

It's time to be a little more specific by restating this question as, "what new accounting capabilities do I need to compete and survive?" We've previously identified these eight goals:

- Cash accounting for taxes.

- Accrual accounting to accurately measure true profitability.

- Production records to evaluate best management practices.

- Inventory control to verify what’s available to sell and what’s been used.

- Cost accounting to determine your farm’s internal costs and margins.

- Budgeting to financially project your operation into the future.

- Benchmarking to standardize and compare your performance with industry leaders.

- Ownership accounting to automate and consolidate your complex business relationships.

We don't recommend tackling all these goals at once! However, you'll eventually need to implement (and hopefully integrate) each of these in order to successfully guide and grow your operation.

Step 3. Set Realistic Expectations for Your Implementation Timeline

Most of us are used to waiting a year for our products to be market ready. Therefore, you need to be equally as patient as your management system parallels each of the unique steps in the production cycle.

Making changes too quickly can invite disruptions, though some farmers may prefer to rip the bandage off and get to work with a new system rather than keeping old systems once they know they aren’t working.

Here, working with a software implementation support team specialized in agricultural accounting solutions can help you determine your needs and give you an idea of what a “realistic” timeline would be.

Step 4. Determine Who, if Anyone, Will Help You Engage in Data Collection

While you need to be personally engaged in the data collection and reporting processes, don't expect this to be a D.I.Y. project. Fortunately, you can tap into two sources of help:

- Outside Help. One way to jump-start your accounting methodology is to seek professional services from an outside business. Our company also provides both on-site and online consulting, training, and help with your day-to-day data processing. You can also take advantage of the webinars, conference resources, and articles found in our News & More page.

- Inside Help. Many of you have grown to the level you can justify a full-time or partial controller or CFO. We can help train them on FBS software or answer technical accounting questions.

Overcoming Obstacles to Implementing Growth Path Accounting

One of the biggest barriers to implementing Growth Path Accounting is the belief that you're permanently "trapped" in your current accounting system. This could be an antiquated program that hasn't been updated in years, generic accounting software recommended by your tax preparer, or even a true ag accounting program that can't integrate with the rest of your farming activities.

While you may be an enthusiastic champion for change in your operations, the other accounting users remain comfortable with their routine even though it's not producing valuable management information for you and the rest of the team.

Finally, even though your current accounting may be a "big bucket" design with limited management details, you don't want to give up your accounting history or re-key vendors, enterprises and transaction details.

Fortunately, the FBS team has both the tools and experience to help new clients successfully exit the "big bucket" accounting wilderness and merge onto the fast lane of Growth Path Accounting.

Contact us now to learn more!