A really big "shew!"

This year's Commodity Classic in San Antonio was so big that, like the immense National Farm Machinery Show we also attend, it was difficult to see and make connections with everyone. Thanks to the customers who did track us down. We look forward to a more manageable-sized venue next year in Anaheim.

Speaking of management challenges, this month we'll share some sobering analysis by management guru Dick Wittman regarding the sad state of management proficiency even among agriculture's elite. We'll follow his report with a possible solution from this month's Farm Futures Magazine.

Also in this month's FarmSmart:

- User Conference reminder.

- Dick Wittman on what it will take to reverse this trend.

- Rethink your farm's financial management.

- Which FBS modules are most popular?

- Trade show calendar.

- April free webinars.

- Link to recorded webinars.

- Handling CDs in FBS.

- Import field data through MACH 2.0. SDG

FBS User Conference Reminder

Even though the planters are still in the shed it's not too early to plan for the premier farm management computer event of the year which is now scheduled for Tuesday, August 22 through Wednesday, August 23 at the Stoney Creek Inn, Moline, Illinois. Watch upcoming issues of this newsletter for details on speakers and topics.

What Will It Take To Reverse This Trend?

Here’s the challenge. After 17 years of teaching at TEPAP*, I have 17 years of data that demonstrates that farm principals representing what should be our most advanced farm agribusinesses are getting progressively worse flunking grades in core proficiencies, in financial management proficiencies and family business governance practices. Here is the most recent summary of my proficiency test after this year’s TEPAP class.

Faculty members, media sponsors and consulting associates analyzing these annual summaries after each TEPAP class have been trying to assess why this is trending negatively. Several reasons have been put forth:

- Younger farmers haven’t experienced stressful times; hence, they haven’t been motivated to get proficient or been forced to do many of the things their parents did in the 1980s and 90s to survive and get continued financing.

- Traditional ag financial management venues (land grants, farm management programs, extension, etc.) have deteriorated in their effectiveness due to budget crunches, mission dilution, attrition from retirements and transfers to private sector.

- Nationally recognized educators and road warriors are retiring, dying or wearing out…the industry hasn’t grown successors with their depth, experience, and effectiveness in reaching farm audiences.

- Ag lenders and financial service providers are victims of technology where professionals are so accustomed to putting numbers in software, they’ve forgotten how or why the software creates the answers (particularly in issues like cash vs. accrual, deferred tax calculations, tax vs book depreciation, trend sheets and ratio calculations, etc.)

- We have an increasing presence of millennials who aren’t getting education or implementation paths in their educational journey on how to apply basic principles of ag financial management (cashflows, Balance sheet on cost vs. market value, debt service capacity, accrual vs cash, etc.)

- Those who value excellence are finding they have to PAY for it and are investing both time and money to access knowledge building. This group is a smaller and smaller percentage of our farm business population. No more free lunch!

The challenge for the Farm Financial Standards Council and all of us providing consulting and financial services is: “What can we do to reverse this trend?” One discussion that continually surfaces is, “What are the resources out there where folks can tap into knowledge building and skills development?”

Editor's note: see the following article and links for one possible solution.

"John McNutt, an Iowa-based MBA with the accounting firm LattaHarris LLP, says a farm’s regular bookkeeper or accountant may not possess the expertise in helping you manage the advances in production technology, correct compliance with Farm Service Agency provisions and marketing fund management."

"Lance Fulton agrees. He is chief accounting officer for Foreland Ag, Garden City, Kan., which has farm operations in Nebraska and Kansas. Fulton notes that most in production ag view accounting as a necessary evil."

(Both of these experts support FBS management accounting software.)

Click here to read the entire March 2017 Farm Futures story to learn how to know when it's time to outsource accounting expertise and what that might cost.

Which FBS Modules are Most Popular?

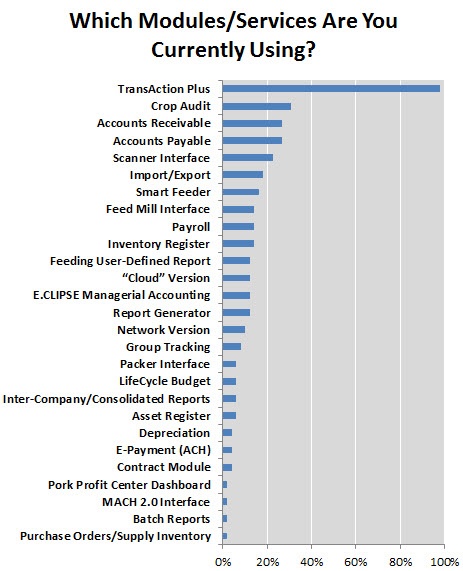

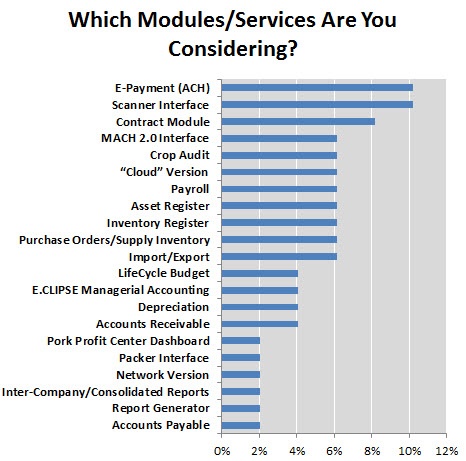

Last month we shared results of an online survey where we asked our clients"How do you use FBS Software?" The two follow-up questions covered this month are "which FBS modules and services are you currently using?" and "which FBS modules and services are you considering?"

Here are graphic summaries of all responses:

Summary:

- Not surprisingly 100% of our users have either TransAction Plus or TransAction Lite accounting since these are our "core" modules.

- The next "top 5" most popular modules in use now are Crop Audit, Accounts Receivable, Accounts Payable, Scanner Interface and Import/Export.

- The most popular modules being considered are E-Payment (ACH), Scanner (electronic document management) and Contract Module.

- Eight other modules are tied for 3rd place, including the MACH 2.0 Interface (see ad below).

- FBS's wide offering of modules and options are a response to not just the diversity in agriculture, but also its growing complexity.

Next month we'll examine the last question in the survey: How can we help you be more successful?

Trade Show Calendar

Please join us for the last national trade show of the season:

| Date |

Show |

Location |

Booth# |

| June 7-9 |

|

Des Moines, IA |

V134 |

April Free Webinars

April 2: Understanding Journal Entries.

April 10: Entering Crop Applications.

April 17: Importing Crop Applications and Harvests through MACH 2.0.

April 24: Using Macros.

All webinars run between 1:00 pm and 2:00 pm CDT.

NEW: Catch up on the webinars you've missed by watching them on the Webinar page of our website.

Q&A of the Month: Tracking CDs

|

| Sarah Dixon, FBS Sales and Support Coordinator |

Q. What's the best way to track certificates of deposits (CDs) in FBS?

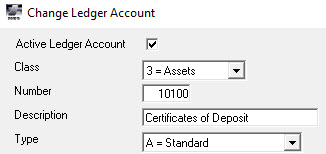

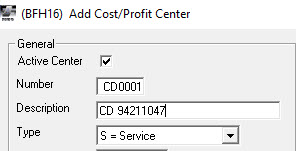

A. I recommend using a single asset account called "CDs" and set up a separate S center for each CD.

|

| Set up a single asset account for all CDs. |

|

| Set up unique S center for each CD. |

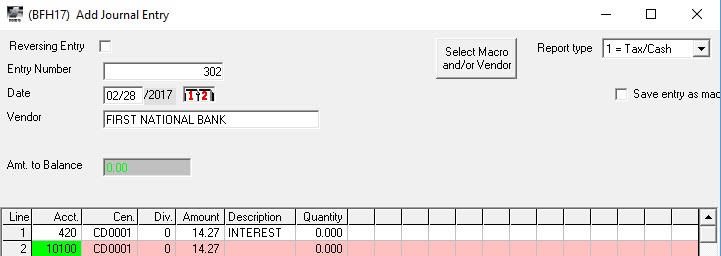

Use a journal entry to accrue earned interest.

|

| Note that both the income and asset sides of the entry are coded to the CD center. |

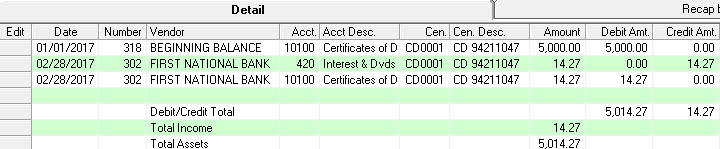

FBS accounting reports will maintain a history of each CD's balance and earned income.

|

| Accounting User Defined Report for the CD center recapped by ledger account. |

Call 800.437.7638 for more information.