We don’t plant blindly. We pay attention to the conditions that make it favorable from season to soil to market conditions and demand. But, when it comes to making decisions about farm management and how to increase profits, drive growth, or even sustain us through lean times, many farms are making those decisions blindly. Management accounting can change that by enabling your team to see how, where, and why money is spent and whether the return on your investment is enough to continue to sow those seeds. When it’s time to adjust, there are few tools better than management accounting and the software that can enable that.

Quick Links

- What is Management Accounting?

- Why is Management Accounting a Good Choice for Farm Accounting?

- 4 Benefits of Farm Management Accounting for Your Farm or Ranch

What is Management Accounting?

When it comes to accounting, there are essentially three types; financial, tax, and management. Financial accounting is more concerned with end of year summary, analysis, and reporting. Whereas financial accounting takes that data and reports it to organizational leadership, tax accounting is similar, but it delivers that information to the government.

Management accounting takes the financial information gathered and prepared from across your organization and applies it to business management and strategic decision-making. In short, management accounting looks at the financial reporting and explains why it looks the way it does, based on performance, and how to improve that performance or how to adjust and pivot where needed.

When it comes to your farm or ranch, management accounting can help analyze your profit centers and help you determine how to increase profitability or whether another profit center is a stronger investment moving forward, based on potential profits and market performance.

Why is Management Accounting a Good Choice for Farm Accounting?

Why is Management Accounting a Good Choice for Farm Accounting?

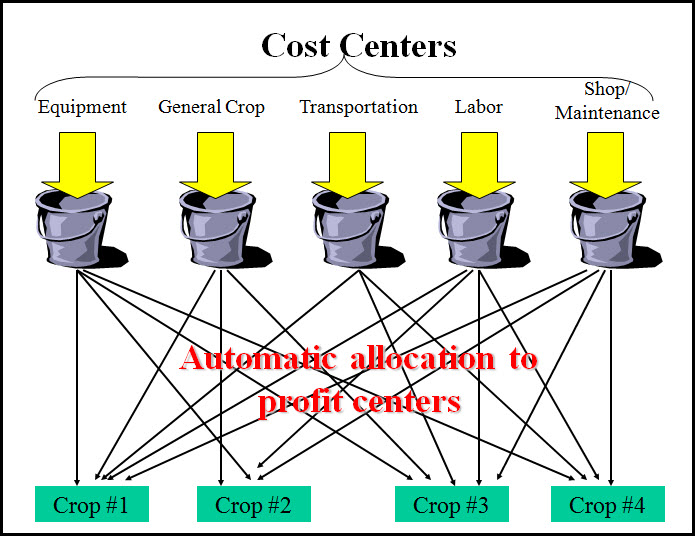

When it comes to the back office at a farm or ranch, it functions much like a central command. They’re handling the financial data coming in from multiple profit centers. They’re also handling multiple cost centers, some of which overlap. Farm accounting isn’t easy, but management accounting can help improve how you use financial data to make informed decisions.

With all the financial data in one location, you’re able to look at how strategic decisions are impacting profits, how costs can be balanced, and determine what a true break even point is for any production unit. From there, important decisions can be made on where to invest, where to pivot, and where to cut costs.

4 Benefits of Farm Management Accounting for Your Farm or Ranch

When it comes to farm management, you want to make the best decisions. That often means taking in a lot of data, not just financial information. However, some of the smartest decisions you’ll make will include input from the farm and from the back office. Successfully combining the essential data can improve overall efficiency, productivity, and profitability.

Make marketing decisions based on reliable, comparable product costs. Unlike conventional manufacturers and retailers, ag producers have traditionally not had the luxury of "setting" prices based on predetermined, positive sales margins every year due to commodity market volatility. However, the transition to marketing contracts permits producers who are confident in their costs of production/sales the opportunity to lock in a modest, but dependably-positive margin. This strategy works better with livestock than with crops because the cost per unit (bushel, pound, etc.) of crop "finished goods" is so significantly affected by yield.

Specialize in your most profitable products. Unless you only raise one crop or animal production segment, determining your best product mix is a critical management decision obscured by all the indirect costs (labor, equipment, fuel, etc.) consumed unequally by those products. Again, crop returns are further complicated by government and crop insurance programs, varying yields and prices, secondary products, and synergetic effects from crop rotations.

Benchmark owned and rented farms and facilities. While yields, prices, and returns between products are hard to predict and control from year to year, the internal costs of owned and rented farms and facilities can be meaningfully benchmarked and effectively managed.

"Right size" your overhead and production capacity. Management accounting can do much more than simply determine historical product costs. All operations are organized around recurring cost center "activities" (planting, spraying, feed preparation, trucking, shop, etc.) rather than products. Knowing your internal cost of performing an activity will allow you to implement these strategies:

- Cost control at a measurable, manageable, and repeatable level.

- Optimize cost center capacity to match levels of production.

- Optimize levels of production to match cost center capacity.

- "Sell" excess cost center capacity by providing custom services to outside entities.

- Replace sub-optimal cost centers by outsourcing custom field operations, contract feeding, toll milling, or turnkey management services.

True management accounting requires robust tools that not only allow you to aggregate all of this financial data in one location but a tool that also allows you to quickly and easily report on the needed data. Farm ERP software does all of that.

Not only does it help gather and report the financial data you need, but it also saves you time while doing it. No more overly complicated spreadsheets or time wasted moving between different programs or different reports sent from multiple sources.

The true value of ERP software is that it simplifies management accounting and enables you to maximize profits, adjust for costs and losses, and make strategic business decisions to grow your operation. If you’re ready to talk about how an ERP system designed by farmers for farmers can change your farm, get in touch with FBS Systems today.