It’s sometimes easy to overlook the back office needs of farming. So much decision making happens in response to conditions in the barn or field, overlooking the role that record keeping and accounting should play in those decisions could be a mistake. But, agricultural accounting isn’t easy. The nuances rely on both the circumstances of farm accounting, production cycles, and generally accepted accounting principles. Combining all aspects takes detailed record keeping, a good understanding of the ins and outs, and the right tools.

Quick Links

- The Agricultural Production Cycle

- Why Farm Inventory Accounting is Important

- Farm Inventory Components and GAAP

- What is Work in Process Accounting?

- Agricultural Accounting and Inventory GAAP

The Agricultural Production Cycle

The agricultural production cycle is, perhaps, one of the primary reasons agricultural accounting can be so complicated. There are few other industries that must maintain records and accounting for products that stretch through multiple quarters and potentially across several fiscal years.

Agricultural production cycles encompass the time from planting, or livestock birth, to finished product going to market. For crops, the production cycle begins when the first costs are incurred for a crop, such as applying fertilizer and ends when the crop is sold. Livestock production begins at birth or purchase and, similarly, ends when the product is ready for sale.

Why Farm Inventory Accounting is Important

As much as we like to believe the hard work of farming happens in the fields and barns, a good amount of hard work on the farm is happening in the back office. More specifically, it’s the record keeping in the back office that enables and validates success in the field.

First and foremost, farm inventory accounting is required for accurate asset management as well as financial reporting. But, beyond answering to the powers that be, the real value of farm inventory accounting is that it’s essential to prudent business management. No other manufacturing or retail firm could stay in business without firm, real-time inventory control. Yet inventory accounting and control are the most frustrating and as a result, neglected business practices in production agriculture. Why? Because inventories rely on both accounting transactions (purchase and sales) and production events (births, deaths, movements, input applications, feeding, and harvests). Like a bank account reconciliation computer inventories must tie out to physical inventories to confirm accuracy. However, on most farms that information is stored in two unconnected systems. As a result inventories must be “double entered,” massaged in spreadsheets, or simply ignored until a balance sheet is required. .

Finally, additional record keeping, when it comes to farm inventory, can allow you to view and manage your cost and profit centers effectively. Examples include monitoring feed and crop inputs on hand, projecting margins on growing crops and livestock, and knowing when products will be available for sale or delivery.

Farm Inventory Components and GAAP

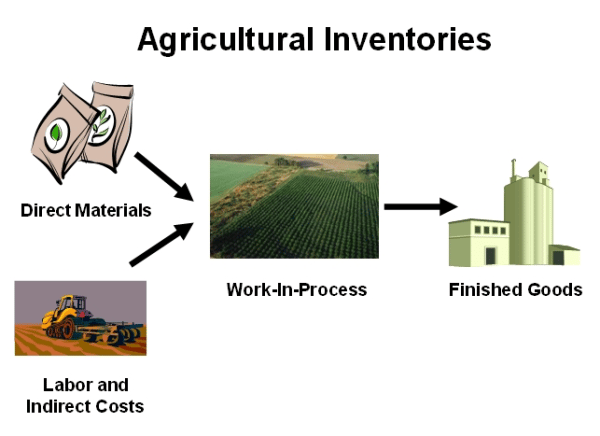

Even with the complications of farm inventories and production cycles, Generally Accepted Accounting Principles (GAAP) are still applicable for the business side of agriculture. When applying GAAP to production agriculture, accountants turn to the manufacturing-sector for guidance. Manufacturing inventories fall into three classifications:

- Direct materials

- Work in process

- Finished goods

Direct materials inventories are raw "ingredients" in stock waiting for use in the manufacturing process. In production agriculture, direct materials include seed, chemicals, fertilizer and feed. These inventories are normally valued at cost in both traditional agricultural and GAAP financial statements.

Work-in-process inventories are all partly completed units found in production at any given point in time, e.g. cars on an assembly line. When it comes to agriculture, WIP inventories are growing animals and crops; they are, technically, unfinished goods. Few farming operations today calculate and report true WIP. Instead, they rely on "quick and dirty" surrogates.

In cropping operations, that surrogate is the "(Cash) Investment in Growing Crops" line found on most agricultural balance sheets. It's an easy value to determine–just total up the cost of the crop inputs "in the ground" at the time of the statement. Unlike true WIP, though, “Investment in Growing Crops” fails to account for the labor and indirect costs (such as fuel, repairs, depreciation and rent) also invested in that growing crop. As a result, assets are often understated and expenses overstated in the accounting period.

Corporate livestock firms already account for WIP, although most use historical cost estimates based on weight or days-on-feed rather than monitoring actual group-cost variances. Family operations (and their lenders) are even less informed, usually basing livestock inventories on purely arbitrary "market" values. WIP calculations for livestock are much more complex than those for crops. For livestock, there are daily, rather than seasonal, activities and the challenges of capitalizing development costs for replacement breeding animals and gestating and lactating "pre-weaned" animals.

Finished-goods inventories are goods fully completed but not yet sold. This includes, for example, harvested crops in storage. In contrast, feeding livestock only achieves the "finished goods" status on the day they are loaded on the truck to the processing plant. Nearly every agricultural financial statement reports these inventories at current market value.

The "New World" approach follows a foundational document published by the American Institute of Certified Public Accountants entitled, Statement of Position 85-3. It concludes with principles for valuing work-in-process (#38) and finished goods (#39) inventories:

- All direct and indirect costs of growing crops should be accumulated and growing crops should be reported at the lower of cost or market.

- An agricultural producer should report inventories of harvested crops held for sale at (a) the lower of cost or market or (b) in accordance with established industry practice, at sales price less estimated costs of disposal, when all the following conditions exist:

- The product has a reliable, readily determinable and realizable market price.

- The product has relatively insignificant and predictable costs of disposal.

- The product is available for immediate delivery.

What is Work in Process Accounting?

What is Work in Process Accounting?

Given those rules and a larger understanding of what WIP means for agricultural accounting, work-in-process should be reported at cost as it accounts for the resources used, but not the finished product.

Finished goods may be reported at the lower of cost or market (with market price calculated as current sales price less estimated cost of disposal). The major challenge is that whether you choose to report inventories at cost or lower of cost or market, you must be able to determine your work-in-process costs. That's why we emphasize management accounting as the first step in moving our clients to financial reporting. This is why accurate and detailed record keeping is essential for the farms and why farm inventory must be properly managed.

Agricultural Accounting and Inventory GAAP

First, being able to differentiate the type of inventory you have is essential. U.S. GAAP Codification Topic 330, requires that any property intended for sale can be considered inventory. Further, direct materials, used to make the final product, work in process goods, and finished goods are all inventory.

Inventory accounts include both WIP and finished goods. While in WIP, those goods are valued for the cost of production, nothing more. When finished, the value is the market or realizable value when sold. For that reason, it’s vital that farm accountants, and profit centers, are maintaining accurate, reliable, and up-to-date records.

Being able to maintain those records and track costs means having the systems in place that make it easy to do so. That’s where FBS Systems and our farm accounting and ERP software come in.

We designed our solution with you, your farm, and the complexities of agricultural accounting in mind by connecting inventories between accounting and production activities. If you’re ready to talk about how to simplify your accounting process, improve your forecasting and predictions, accurately track and manage your inventories, get in touch with our team today!