|

Thank you for your business and trust.

“Glory to God in the highest, and on earth peace among those with whom he is pleased!” (Luke 2:14)

|

Dear Friend,

Thanks for following the FBS team on our 43-year journey into computerized farm management. Now it's time for a new chapter, and we have some exciting news to share!

In this month's news:

- MASA acquires FBS.

- New 1099 and W-2 e-filing requirements.

- FBS/MASA Users in the news.

- Read our December Farm Management Accounting blog posts.

- Q&A: Tax reports from FBS.

SDG

MASA Acquires FBS

Capstone Chapter, Continued Commitment

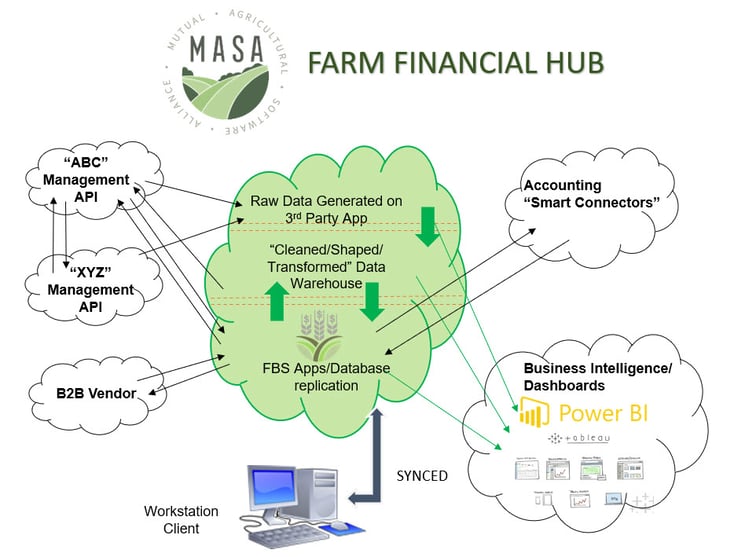

Building on a successful 4-year joint venture, the Mutual Agricultural Software Alliance LLC (MASA) has acquired the assets of FBS Systems, Inc. MASA is a network of forward-thinking FBS users who are developing an open architecture software platform to link financial, production and other important information into a common cloud database. As a result, users will be able to make timely, data-driven decisions based on an accounting-reconciled Enterprise Resource Planning (ERP) system that “is a robust enough tool that allows you to do a deep dive into understanding your farm business,” says John McNutt, MASA Board President.

FBS Systems has more than 40 years of industry experience creating and refining integrated software tools to promote efficient processes across large agricultural production enterprises. MASA is leveraging FBS’s experience and expertise to integrate ag production and accounting into private cloud databases and will move forward with a farm financial hub that connects with multiple data sources on and off the farm.

“This acquisition means that there is a path forward for FBS customers to get their needs met with digital accounting tools,” says Dr. Jordan Lambert, Director of Ag Innovation at Colorado State University. “MASA takes FBS’s innovative history and put a new financial and governing structure around it."

As MASA and FBS continue to explore this new phase for farm data management, MASA will take a service-forward approach to ensure that users have access to resources that will help them effectively use their tools across operations. These tools will continue to be refined based on feedback received from MASA members.

For more information, contact Interim CEO Brian Watkins (brian@kenton.com).

|

1099 and W-2 E-Filing Requirements for 2023

The IRS has recently introduced a new e-filing requirement for both 1099 and W-2 forms, aiming to streamline the tax reporting process. Starting January 1, 2024 employers and businesses are required to electronically submit their 1099 and W2 forms if they have a combined amount of forms that equal 10 or more.

FBS/MASA clients can e-file W-2s through CenterPoint Payroll and 1099s through TransAction Plus accounting (see the Q&A column below).

|

|

FBS/MASA Users in the News

Tod Wiley, a pig farmer from Walker, Iowa offers a virtual tour of his sow barn as a part of a FarmChat(R) program, co-hosted by the Iowa Literacy Foundation and the Iowa Pork Producers Association.