Q&A: Three Overhead Options

|

| Sarah Dixon, FBS Sales and Support Coordinator |

Q. How do I get costs of equipment, land, repairs and other expenses to the field or group levels?

A. There are three ways to do this:

- Through Crop Audit field operations.

- Use the overhead allocation tables.

- Cost Drivers through E.CLIPSE.

Option 1

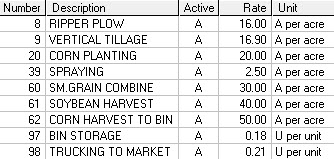

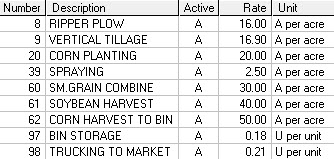

Crop Audit allows you to assign operations such as planting, spraying to the field through Field Operations. Go to Setup>Crops>Field Operations.

Either using your state university’s published custom rates or your own estimation of your cost of fuel, labor, wear and tear on the machine enter the Per Acre, Per Hour, Per Mile or Per Unit (bushel, point of moisture, etc.). The Crop History Report computes operation costs using these values as does the Crop Cost Analysis Report if you check the box for Use crop operations costs.

Advantages: Quick and easy cost analysis and projects at the field level without requiring any accounting knowledge or entries (temporary, report-time calculations).

Disadvantages: Uses potentially misleading, unreconciled “plugged” values.

Option 2

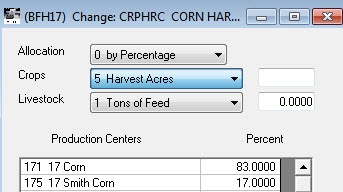

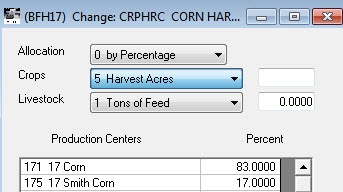

Use the Overhead Allocation Table (Setup>Overhead Allocation Table) to allocate by percentage from a Consolidating Center (such as the Crop Harvesting Center in this example) between Production Centers using percentages.

Advantages: Will allocate actual costs assigned to a Consolidating Center out to Production Centers without requiring any accounting knowledge or entries (temporary, report-time calculations).

Disadvantages: Only allocates direct costs from the Consolidating Center, and no field or group-level costs analysis.

Option 3

|

|

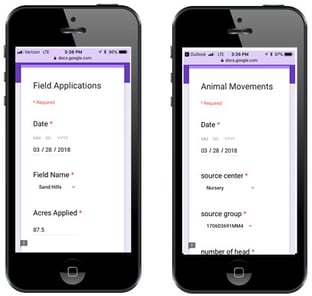

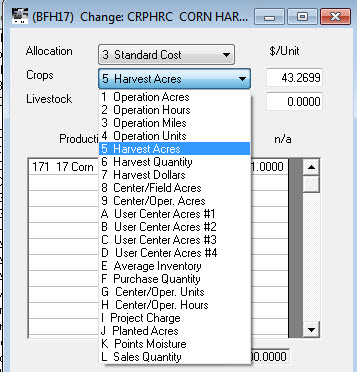

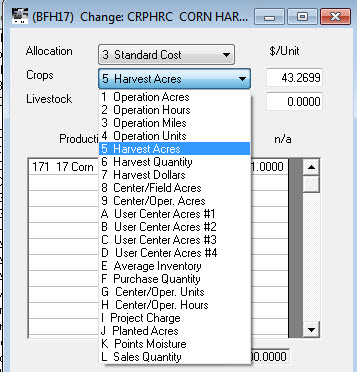

| Crop Cost Drivers |

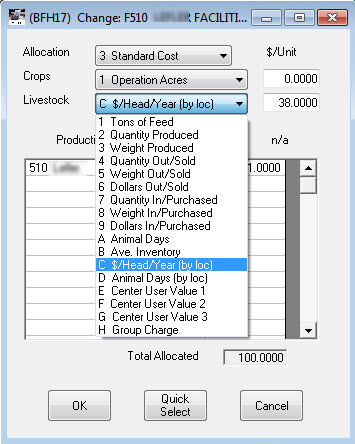

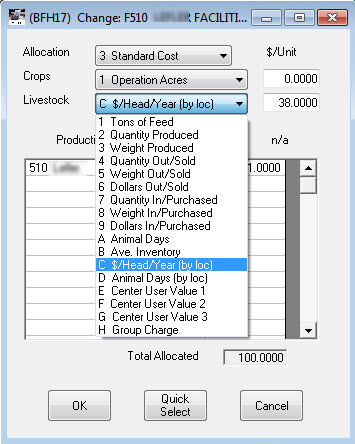

Livestock Cost Drivers |

Using the E.CLIPSE Management Accounting system select an appropriate crop or livestock Cost Driver such as Operation (trip) Acres or $/Head/Year (by location). Begin with an estimated Standard Cost to “prime the pump.” As time goes on the system can automatically adjust the rates to reflect actual costs or you can leave the standard rates in place and monitor the variance in projected versus actual overhead costs.

Advantages:

- “Multi-hop” allocations from Labor or Equipment Centers to Consolidating Centers to Production Centers.

- Cost Drivers can be linked to Field Operations.

- Automatically adjusts to actual costs.

- Full cost absorption and analysis at the field or group levels.

- Generates work -in-process (WIP) cost flows through your balance sheet.

- Creates detailed audit trail of allocation transactions.

Disadvantages: Requires either internal management accounting knowledge or access to virtual controller (see Farm Software Success article above).

If you’d like to begin implementing one of these practices and need some assistance then please contact Sarah in support!